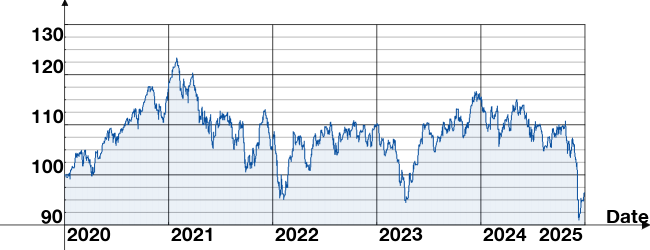

PRICE EVOLUTION:

- YTD

- 1M

- 3M

- 1Y

- Interval

- as per

Aggregated return during this time range :

Investment policy

The objective of the subfund is to realize a medium- to long-term performance by investing in international equities (OECD), allowing investors to contribute to the energy transition.

The subfund is aligned with European Union taxonomy criteria (list of sustainable activities) and follows best market practices in order to contribute to the mitigation of climate change.

LUXFUNDS-EQUITY Green invests in company that seek to improve their environmental footprint while providing assurance that they comply with into account social criteria.

This subfund is eligible for S-Invest, the strategy for investing in LUXFUNDS sicavs.

Aggregated return*

| YTD (02/01/2025) | -10.45% |

| for 1 month (21/03/2025) | -9.32% |

| for 3 months (23/01/2025) | -11.05% |

| for 6 months (23/10/2024) | -13.63% |

| for 1 year (23/04/2024) | -12.11% |

| for 3 years (22/04/2022) | -12.98% |

| as from creation (04/12/2020) | -3.68% |

Investment allocation as per 31/07/2024

Geographical Breakdown as per 31/07/2024

Sector breakdown as per 31/07/2024

Top Equity Investments as per 31/07/2024

| Iberdrola SA | 4.32 % |

| SAP SE | 4.30 % |

| Kingspan Group | 4.23 % |

| Republic Services Inc | 4.22 % |

| Veolia Environnement SA | 4.19 % |

Technical details/characteristics

| Investment fund types | Sector or Thematic Funds |

| Issue date | 16/11/2020 |

| Reference Currency | EUR |

| Type of shares | cap. |

| LU Withholding tax | No |

| Calculation of the net asset value | Daily |

| For every subscription today (day J) before noon (Luxembourg time), the NAV of tomorrow (day J+1) will be applicable, except for sundays and holidays. | |

| ISIN code (cap.) | LU2173353967 |

| WKN number | A2P4GV |

| Cut-off time | 12:00 (GMT+1) |

TEMPERATURE RATING OF THE PORTFOLIO

|

|

CHARGES

| Entry charges | 2.5 % |

| Exit charges | 1 % |

| Charges taken from the fund over a year | |

| Ongoing charges | 1.36 % |

| Charges taken from the fund under certain specific conditions | |

| Performance fee | None |

Detailed Informations about the fees and charges are in our publication concerning the main banking fees available at www.spuerkeess.lu and in our branches.

Taxation

AS AT 23/04/2025

|

|

| LU2173353967 cap. | |

|---|---|

| TIS belge | -1.39 EUR |

Important notice:

Please note that the above subfund may only be distributed in Luxembourg. Shares of funds of our lux|funds range may not be sold to US Persons.

Any subscription must be done on the basis of the fund's prospectus in effect at the time of subscription and the KIID ("Key Investor Information Document"), accompanied by the latest annual report or, if more recent, the latest interim report.

For every subscription today (day D) before noon (Luxembourg time), the NAV applicable will be the NAV dated today (D), which will be calculated and published the next day (day D+1), except for Sundays and holidays.

The indicated historical performance levels are not a guarantee of similar growth in value in the future. Losses of value cannot be ruled out, and Spuerkeess may not be held liable for them. The actuarial yield represents the yield obtained when a bond portfolio is held to maturity.

The level of risk is determined on the basis of the historical performance of the last five years and should not be considered a reliable indicator of the future risk profile of the compartment. It represents the risk of fluctuations in the net asset value per share and may change over time. Level 1 represents the lowest risk, and level 7 represents the highest risk. The higher the risk, the longer the recommended investment period. For details on the risks involved, please consult the KIID.

The entry and exit charges are those indicated in the prospectus. The actual applicable charges are in our publication concerning the main banking fees available at www.spuerkeess.lu and in our branches.

Tax information about the fund is available at www.luxfunds.lu and at Spuerkeess branches. It is recommended that investors consult their own legal and tax advisers before investing in the fund.

This document is provided solely for information purposes and cannot be considered legal, tax, or investment advice.

1.98°C

1.98°C